What Does Scarborough Mortgage Broker Do?

Wiki Article

The Definitive Guide for Mortgage Broker Scarborough

Table of ContentsNot known Facts About Scarborough Mortgage BrokerScarborough Mortgage Broker Can Be Fun For EveryoneThe Ultimate Guide To Scarborough Mortgage BrokerThe 30-Second Trick For Mortgage Broker Near MeUnknown Facts About Scarborough Mortgage BrokerGetting My Mortgage Broker Scarborough To WorkThe smart Trick of Scarborough Mortgage Broker That Nobody is DiscussingThe Basic Principles Of Scarborough Mortgage Broker

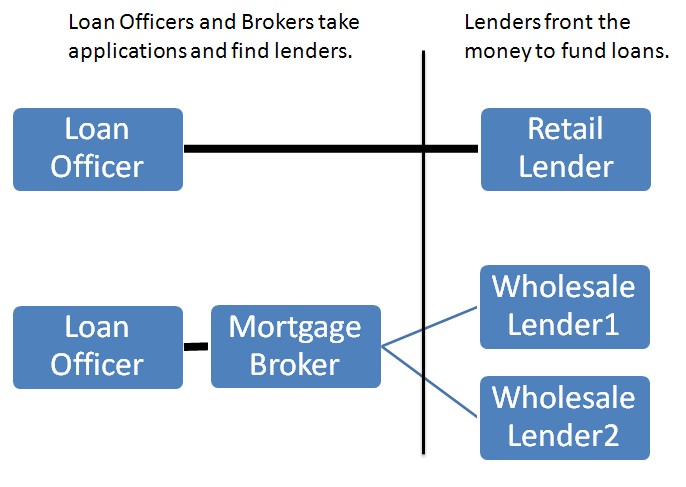

One of one of the most confusing parts of the home mortgage process can be identifying all the various type of lenders that sell home loans and also refinancing. There are direct lending institutions, retail lenders, home mortgage brokers, portfolio lending institutions, reporter loan providers, wholesale lending institutions and others. Several consumers simply head right into the process and also seek what seem practical terms without bothering with what kind of loan provider they're handling.

The 5-Minute Rule for Mortgage Broker

Explanations of several of the primary kinds are supplied listed below. These are not always equally unique - there is a reasonable amount of overlap among the various classifications. The majority of portfolio lenders often tend to be straight lending institutions. And also lots of loan providers are associated with greater than one kind of financing - such as a large financial institution that has both wholesale and retail lending operations.

Mortgage Broker Near Me for Beginners

What they do is collaborate with numerous lenders to find the one that will use you the ideal price and also terms. When you obtain the car loan, you're borrowing from the loan provider, not the broker, that merely acts as a representative. Usually, these are wholesale loan providers (see below) that mark down the prices they supply via brokers contrasted to what you 'd get if you approached them directly as a retail customer.Wholesale and also Retail Lenders Wholesale loan providers are financial institutions or various other organizations that do not deal directly with consumers, but supply their loans through 3rd events such as home loan brokers, lending institution, other financial institutions, and so on. Commonly, these are big financial institutions that additionally have retail procedures that collaborate with customers directly. Numerous large financial institutions, such as Bank of America and Wells Fargo, have both wholesale and also retail operations.

See This Report on Mortgage Broker Near Me

The vital difference here is that, rather of offering car loans via intermediaries, they provide cash to banks or other mortgage loan providers with which to release their own financings, by themselves terms. The stockroom loan provider is repaid when the home loan lending institution markets the financing to investors. Home loan Bankers An additional difference is in between profile lenders as well as home loan lenders.

mortgage loan providers are home loan lenders, who do not offer their very own cash, yet borrow funds at temporary prices from storage facility lending institutions (see above) to cover the home loans they release. As soon as the mortgage is made, they sell it to investors and also pay back the temporary note (mortgage broker in Scarborough). Those mortgages are typically offered with Fannie Mae as well as Freddie Mac, which allows those agencies to set the minimum underwriting standards for most mortgages issue in the United States.

Get This Report about Mortgage Broker In Scarborough

This makes portfolio loan providers an excellent selection for "specific niche" customers who do not fit the normal loan provider profile - perhaps because they're looking for a jumbo finance, are taking into consideration a special property, have actually flawed credit score but solid financial resources, or may be considering financial investment building. You may pay greater rates for this solution, but not constantly - since profile loan providers have a tendency to be really cautious who they offer to, their rates are occasionally rather reduced. mortgage broker near me.Hard cash lenders have a tendency to be private individuals with money to offer, though they may be established as service operations. Rates of interest tend to be fairly high - 12 percent is not uncommon - as well as down settlements may be 30 percent and also above. Difficult cash lending institutions are normally used for temporary loans that are expected to be settled rapidly, such as for financial investment residential property, instead than long-term amortizing car loans for a residence purchase.

The Best Guide To Mortgage Broker Scarborough

Once again, these terms are not constantly unique, however rather usually explain kinds of mortgage features check these guys out that various my review here loan providers might perform, often at the same time. Comprehending what each of these does can be a terrific aid in comprehending how the mortgage procedure works and also form a basis for examining mortgage deals.I am opened up! This is where the material goes.

The Ultimate Guide To Mortgage Broker In Scarborough

If you have ever prepared to get a home or have a good friend that did it, you have most likely heard of an expert called Mortgage Broker? Do you recognize what their function is in the procedure of funding a building or exactly how can it be advantageous for you? Home mortgage brokers work as middlemans between lenders and debtors.Let's dig deeper right into this procedure: The very first step to take when acquiring a home in Australia is to obtain a statement from the bank you go to this site are borrowing from, called pre-approval (please examine this blog post to recognize how the pre-approval jobs in information). To be able to do that, you initially need to locate a financial institution that settles on providing you the cash.

Examine This Report about Mortgage Broker In Scarborough

Using a mortgage broker provides you several even more options. Not just when it comes to finest car loan deals, but also for saving time as well as avoiding mistakes that could get your car loan rejected.

Report this wiki page